The Canadian housing market as of May 2024 presents a mixed outlook based on slow activity in the month. While there is anticipation of increased activity following the Bank of Canada rate cut, the impact has been slow to materialize. Many prospective buyers are still cautious, waiting on the sidelines to see how further rate cuts will influence market conditions. As a mortgage broker, I believe that working with a mortgage broker will be crucial in navigating these uncertain times. Here’s a detailed look at the current state of the market and why mortgage broker expertise will be vital.

Market Overview: May 2024

May was relatively uneventful for many Canadian housing markets. National home sales recorded a slight dip of 0.6% from April, continuing to stay below the average of the last decade. Despite this, new listings edged up marginally by 0.5%, indicating a slight increase in available properties for sale.

National home sales activity in Canada over the past few years, highlighting a 0.6% decrease between April and May 2024.

The actual (not seasonally adjusted) activity showed a 5.9% decline compared to May 2023. Home prices have largely remained stable, showing minimal movement with a 0.2% dip in the MLS® Home Price Index (HPI) month-over-month and a 2.4% decrease year-over-year. The national average sale price fell by 4% year-over-year, settling at $699,117 in May 2024.

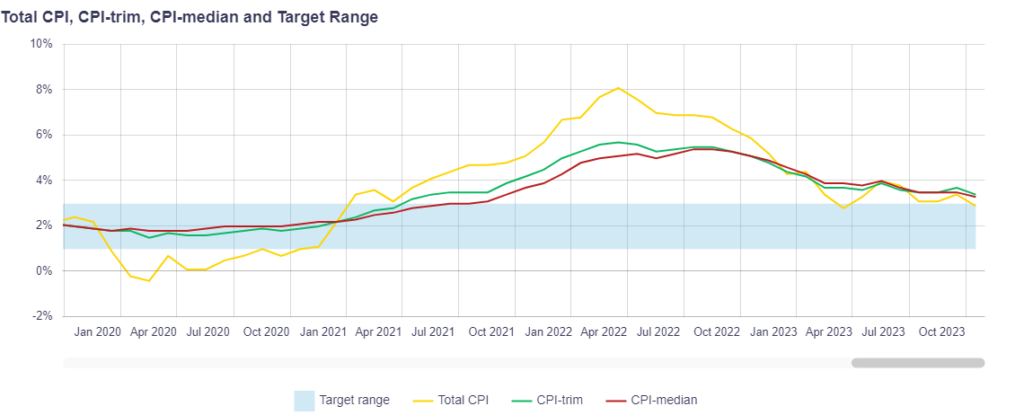

Impact of the Bank of Canada’s Rate Cut

On June 5, the Bank of Canada implemented a 25-basis-point rate cut, a move expected to have significant psychological effects on the market. According to Shaun Cathcart, CREA’s Senior Economist, this initial rate cut is likely to encourage many prospective buyers, who have been hesitant, to consider entering the market. The question now is whether additional rate cuts will follow and how quickly they will occur.

James Mabey, Chair of CREA, also emphasized the potential for increased demand, noting that this rate cut could prompt a resurgence of interest from buyers who had been waiting for more favorable conditions. With more homes available now than at any point in almost five years, the market could see a shift in activity in the coming months.

Current Market Dynamics

The national sales-to-new listings ratio eased slightly to 52.6% in May from 53.3% in April, indicating a balanced market. This ratio typically ranges between 45% and 65% in balanced conditions. The inventory of homes for sale increased to 175,000, up 28.4% from a year earlier but still below historical averages.

Number of new listings in the Canadian housing market from 2019 to 2024, showing a slight increase in May 2024.

There were 4.4 months of inventory at the end of May, a slight increase from 4.2 months in April, and the highest level since the fall of 2019, excluding the pandemic-related volatility. This suggests that buyers currently have more options to choose from, which could influence their purchasing decisions in the near future.

Regional Variations in Home Prices

While home prices are generally stable across most of Canada, some regions have seen consistent increases. Calgary, Edmonton, and Saskatoon have experienced a steady rise in prices since early last year, defying the broader national trend of sliding or stagnant prices.

The non-seasonally adjusted National Composite MLS® HPI remains 2.4% below May 2023 levels, reflecting the rapid price increases that began in April of the previous year but have not been repeated in 2024.

Looking Ahead

The recent rate cut by the Bank of Canada is anticipated to invigorate the housing market, but its full impact is yet to be seen. Prospective buyers may still be waiting for further rate reductions, which could delay a significant uptick in market activity. However, with a higher number of listings and a balanced sales-to-new listings ratio, the market is poised for potential growth once confidence returns.

For those considering entering the market, now might be an opportune time given the increased inventory and the possibility of future rate cuts. Consulting with a mortgage broker can provide valuable insights and guidance tailored to your financial situation and the evolving market conditions.

The data and insights provided by The Canadian Real Estate Association (CREA) highlight the current state and potential future trends of the Canadian housing market. As the effects of the recent rate cut begin to unfold, having a mortgage broker on your side will be crucial for making informed and advantageous decisions.

Amandeep Bains

(416)771-9834

M23007753

Mortgages with Amandeep

Instagram

Facebook

Source: The Canadian Real Estate Association