As Canadian inflation shows signs of a slowdown and speculation swirls around potential moves by the Bank of Canada, the dynamics of the real estate market face renewed scrutiny. Against a backdrop of tightening supply and heightened activity, the impact of shifting economic trends on the housing sector becomes increasingly pertinent. With key indicators such as mortgage interest rates and rent costs affected by the broader inflationary landscape, understanding the interplay between these factors is essential for stakeholders navigating the evolving real estate market.

Overview

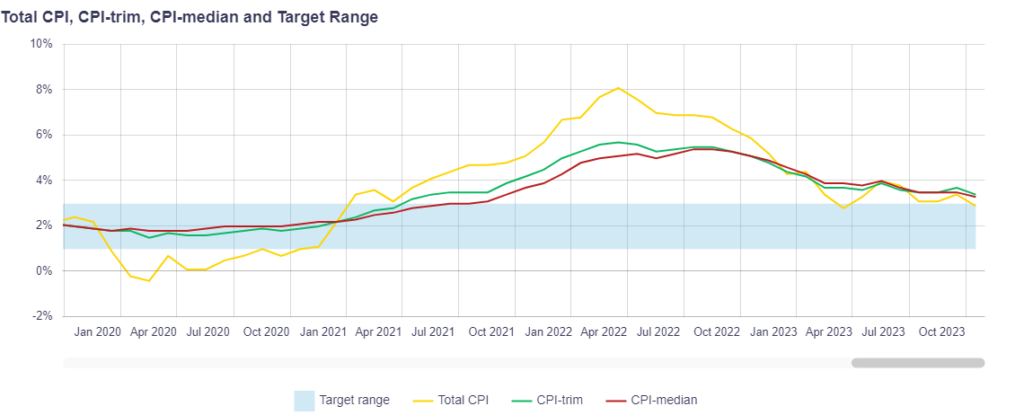

In January, the Consumer Price Index (CPI) experienced a noticeable deceleration, with a year-over-year increase of 2.9%, down from December’s 3.4%. Excluding gasoline, the headline CPI slowed to 3.2% year over year. On a monthly basis, the CPI remained unchanged, following a decline in December.

CPI continues its movement towards the BoC target range

Factors

The decline in gasoline prices was a significant contributor to the overall slowdown, driven by base-year effects and temporary tax suspensions. While grocery prices maintained elevated levels, their growth rate decelerated across various categories. Airfare prices also decreased notably, reflecting reduced demand post-holiday season. Wage growth remains elevated, coupled with a strong start to the year for labor markets. Mortgage interest cost growth is slowing but continues to drive a disproportionate share of CPI growth. Home rent growth is still accelerating, highlighting persistent challenges in the housing market. These dynamics underscore the complex interplay between labor market trends, housing costs, and inflationary pressures, which will likely influence monetary policy decisions moving forward.

Outlook

Looking ahead, the inflation trajectory remains uncertain amidst ongoing economic uncertainties and supply chain disruptions. Despite January’s better-than-expected inflation report, inflation remains well above the 2% target. Shelter inflation is expected to persist, driven by higher mortgage rates and housing shortages impacting rents.

The renewed real estate activity in the market amid tightening supply could potentially face moderation in growth due to the deceleration in inflation observed in January. While the housing market continues to experience robust demand, the slowdown in inflation, particularly in housing-related costs such as mortgage interest and rent, may slightly alleviate pricing pressures. However, sustained wage growth and ongoing supply constraints could mitigate the impact, maintaining resilience in the real estate sector.

Bank of Canada Meeting

The upcoming Bank of Canada Governing Council meeting on March 6 will be crucial in assessing monetary policy decisions. While January’s inflation report suggests a narrowing breadth of inflation, it still exceeds the targeted level. With wage gains remaining high and core inflation measures above 3%, the Bank is likely to maintain a cautious stance. It’s anticipated that the Bank will closely monitor economic indicators and inflation trends, with the possibility of rate cuts in the future. Amidst these factors, there’s a prevailing view that the Bank may initiate rate cuts, possibly starting in June.

Source: Statistics Canada